So, what are options?

Since we already know why investors trade options, it’s important to know what they are exactly. The technical definition states: An option gives the buyer the right, but not the obligation, to purchase a security at a set price within a defined time period. Although the technical definition is informative, it can be quite confusing to people not familiar with the understanding of financial lexicon. So let’s describe options in Laymen’s terms so everyone can understand!

To analogize, we’ll compare options to the act of purchasing cars. Imagine you are in the market to buy a new car. So in your journey to find this perfect car, you come across a vehicle that tickles your fancy; however, you become hesitant to pull the trigger. You don’t purchase it outright because you’re not sure if you should go through with it or it’s because the car is a few dollars out of your budget.

So you approach the owner of the car and you indicate your interest to purchase the vehicle. You ask him if he can agree to allow you to buy the car at a set price within some timeframe. The owner likes you and comes back and says, “Sure, for a $1000, you can have the option to purchase this car within three months for a set price of $10,000. I won’t sell this car to anyone else in the meantime”. You pay the $1000 and you now own the contract that gives you the right, but not obligation, to purchase this car within three months for $10,000.

Time passes by and the car goes up in value to $20,000 because it turns out to be a collector’s item and Jay Leno is swooping all of them up. You come to conclusion that you don’t need to drive such a fancy car. This effectively gives you two choices: 1) You can purchase the car for $10,000 and attempt to resell the car at market value or 2) you can sell the actual car option agreement to someone interested in the fancy car for 5X to 7X the initial contract value of $1000. In both cases, you make money!

Now the opposite position hold true as well. Let’s say that the price of the car all of a sudden plummets because it is determined that the car is unreliable and unsafe for travel. You have originally purchased the right to buy the car at $10,000, but now the value of the car sits around $3000. Since the option contract gives you the right, but not obligation, to buy the car at $10,000, you prudently allow the option to expire after 3 months because the current value of the car is much lower than the original agreed-to purchase price. The car owner keeps the initial $1000 and you walk away car-less and $1000 lighter in the wallet.

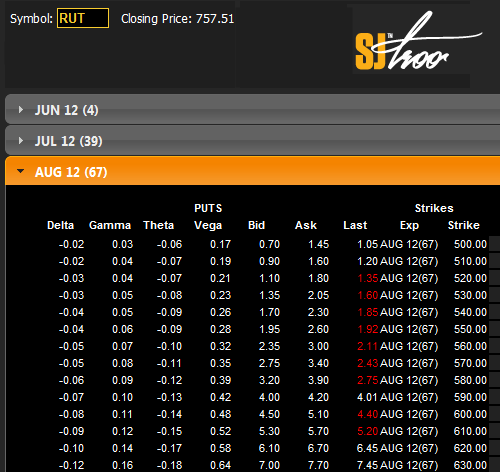

In a nutshell, this is the basic premise on how options work. To bring this all back to stock options, shares of stock are the “vehicles” we can purchase. The set prices for these “vehicles” are called Strike Prices. The actual cost of an option per set price is called Option Premium and they are categorized as Bid/Ask prices. Lastly, like the car example, options have a time element to them. They expire on their Expiration Date. All of this information can be found on a Traditional Option Chain Chart like the one below:

Here are some key points about options:

· A contract controls 100 shares of stock.

· An option is a legal binding contract.

· You not only need to watch the price of the underlying and option premium, but also the time to expiration.

· Options can be used individually or combined for more advanced strategies.

· Options generally expire on the Saturday following the 3rd Friday of every month.

As always, a solid option course is recommended should you decide to take the plunge into option trading. A good options education course can help you identify the risks of option trading and opportunities to maximize profits. To learn more about options, check us out here at SJ Options and learn why we are the preferred options education company for risk-averse and sophisticated investors.